2019 Punch Card Conference notes

I was lucky enough to get invited by a friend to the 2019 Punch Card Conference, the annual event for Project Punch Card, “a nonprofit that supports underrepresented groups in the investment field and a long-term investment orientation”. Below are my notes from the event, with some occasional commentary of my own. As usual, none of this is investment advice.

The notes are in order of when the speaker presented:

1) Rupal J. Bhansali, Ariel Investments

2) Eileen Murray, Bridgewater

3) Pat Dorsey, Dorsey asset management

4) Victor Khosla, SVP Global, Robert Koenigsberger, Gramercy Funds, Andrew Herenstein, Monarch

5) Barbara Ann Bernard, Wincrest Capital

6) Cliff Asness, AQR

7) Michael Weinberg, APG

8) Jamie Dinan, York Capital

9) Michael Mauboussin, BlueMountain

Rupal J. Bhansali, Ariel Investments

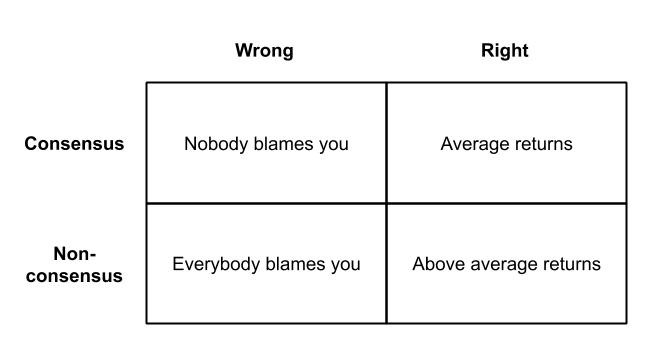

- Investing is about contrarian thinking

- If your correct view is already in price, there’s no payoff. You get big payoffs for upset victories, but also big penalties for wrong answers

- The conventional belief is that you either accept high returns, high risk or settle for low returns, low risk. I refuse to accept that

- It’s about diagnosing companies and situations correctly. The very thing that causes you to lose money is also the thing that can cause you to make money if diagnosed correctly

- The biggest thing is understanding the quality of what you’re getting into, and being against consensus

- For example, tire companies are normally thought of as boring businesses, and being long a tire company could be non-consensus. Michelin has returned 2x the auto sector because tires are a mission critical component, need to be replaced regularly, and Michelin has a manufacturing advantage, among other reasons

- For example, Apple could be a low quality company because it’s in consumer electronics, gives the same user experience as others, has multiple threats, and an eroding advantage. It also stopped reporting unit sales and is investing in content. Could it be the next Blackberry? Blackberry didn’t look like a low quality company if you just looked at financials, until it was too late

- A portfolio manager that beats the market over the long term could have underperformed for long periods of time

- It’s a myth that corporate governance is superior in US. We’ve seen some of the worst corporate governance in US e.g. stock buybacks enriching mgmt, expensive M&A

LL - As I’ve written about before, being both contrarian and right is what makes you money, but it’s harder than people think. I agree that it’s a myth corporate governance is superior in the US; it’s bad on average everywhere.

Eileen Murray, Bridgewater

- I looked at opportunities for diversity and inclusion, wasn’t proud that I was the only woman at events

- How do you think about finding sponsors vs mentors?

- There’s a difference. Sponsors are more relevant for your current workplace. They care about whether you are the right person for the job etc.

- Sponsorship was more of the path with me

- I’ve also mentored others but since i’m not in their company i cant help them as much

- The bigger thing you have to understand is that you need to know who to get help from rather than feel like you have to know everything

- What career advice would you give?

- Understand what you want to do and not do,

- Can you imagine yourself being in a role,

- Figure out what you’re good at,

- But I acknowlege all of that is hard to know

- Call it out when you see ppl being excluded. It’s not just about diversity but also inclusion

- There’s a “dots system” at bridgewater which we use to evaluate ppl, it was invented by Dalio, and is continuously evolving

- We evaluate people across many dimensions and have a “baseball card” profile of everyone

- Should we aim to get ppl better at their strengths or weaknesses?

- I first ask them what is it you want to do, what do you need to evolve to do that,

- Bridgewater does lose a large proportion of ppl in first few mths, doesnt overindex on any gender or cultural group.

- However, more senior ppl do attrite at higher rates. They come in excited to give radical feedback, but when they get radical feedback they’re not as accustomed to it

- Senior people are ~70% of the ppl that leave

- What I worry abt is ppl that are inherently introverted and how we are giving them space to speak at Bridgewater

- How do you assess fit when you’re applying for a job?

- You should look at the management team, meet with ppl in the company,

- “could i see myself working with that person for 18hrs”

- I was lucky in getting the support from a mentor at work early on

- He would tell me regularly what i did right and wrong

- What do you attribute for success?

- Some of it was luck, some of it was being prepared for meetings,

- I do think that womens investing clubs create an advantage but I wouldn’t be apologetic about that.

- All groups will create an advantage e.g. ivy league schools make it easier for you to get a job.

- It’s up to you to create your own advantage.

LL - I wasn’t aware of the sponsor vs mentor distinction before, but it makes sense. It seems the main difference in sponsors vs mentors is sponsors can advocate for you and get you promoted.

It’s interesting how people with more experience like Eileen will be more self-aware, realising that you don’t need to know everything and that luck plays a big role in success. I also like how she was concious of getting participation from introverts/non-social people, and that ties in nicely with Barbara’s and Michael’s points later about cognitive diversity. If you are an introvert though, I’d still recommend speaking up. See what David Laing wrote for more detail

Pat Dorsey, Dorsey asset management

- $680mm AUM, 10-15 positions, currently have 11 positions, with 60% capital in top 5,

- We don’t use expert networks, self-source all our research

- Launched with $6mm in capital and no track record, except the network from morningstar days

- Moats are when you have pricing power, created via

- intangible assets,

- switching costs,

- network effects,

- cost advantages

- Moats matter because they increase biz value by lengthening the period where capital can be reinvested at high ROIC

- Income paid out to investor must be reinvested by the investor in a competitive equity market

- My colleague thinks of dividends as a “unilaterally imposed tax event”

- The opinion of dividends varies among countries e.g issuing a dividend means you’re no longer treated as a growth company in the US, but dividends are liked in europe and australia

- Some expenses on the income statement can be investments, hence low current margins does not necessarily equal to a bad business

- We know that large scale M&A usually fails. It has to be part of corporate strat e.g. danaher, constellation software

- You can’t screen for switching costs in bloomberg, must talk to customers to figure that out

- You can’t assume that reinvestment is NPV positive for the company, have to understand long run economics

- Quantitative data is priced efficiently. Qualitative insight is less efficiently priced, since people don’t go out to talk these days. Everyone talks to the same people that the expert networks send them

- What’s one thing you’ve changed your mind on?

- I used to think that moat was more impt than management, might not agree entirely now.

- Management’s strategic choices have high influence and impact on how the business gets built

LL - Expert networks are widely used in the investment industry; the better known ones include GLG, Alphasights, Third Bridge. Investors will pay to get in contact with subject matter experts who have experience in the industry or company they’re interested in. For example, if you’re interested in Booking.com, you might want to get on the phone with the former COO.

In the past, you could get alpha from these networks, since fewer people were using them. Now however, nearly every firm uses expert networks. Since it’s your relative, not absolute edge that contributes to alpha, expert networks have become more table stakes rather than alpha generating

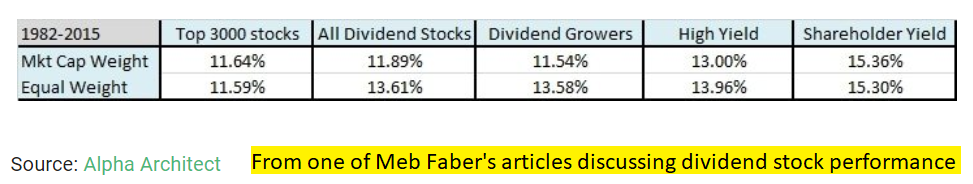

On dividends, Meb Faber has written extensively about them.

On management vs moat, it makes sense that management matters, but it’s hard to determine in advance whether a management team is good or not. I’ve found that most people end up rationalising this after the fact rather than before.

Victor Khosla, SVP Global, Robert Koenigsberger, Gramercy Funds, Andrew Herenstein, Monarch

- Below section notes are for the entire panel as I wasn’t able to note down who mentioned what

- We have a morning meeting with idea pitches that everyone in the firm sits in on

- Want to make sure everyone gets chance to ask and answer qns

- You’re not just reviewed on work you’ve done but also on participation in the investment process

- There’s a huge dislocation risk in emerging mkt credit. Not saying don’t take the risk but be aware of it and how much risk you’re willing to take

- “sourcing is magic”, particularly in private stuff

- A common theme in our mistakes during distressed investing is when we didn’t get the control we thought we had. We were buying secured, senior debt but still didn’t get control we needed e.g company with a union

LL - I like the idea of evaluating people on participation, though I wonder if I’d like it if I actually had to live through it. I understood the need for it in college classes but it always struck me as contrived, with people gaming the system by speaking up even though they had nothing of substance to say.

Barbara Ann Bernard, Wincrest Capital

- The drivers for historical returns in US are not going to be repeatable for the future

- e.g. look at the differenc in P/E, dividend yields, treasury yields, share buybacks in the past compared to now

- America doesnt have a housing crisis like in ‘08 but we have a debt crisis.

- Look at the corporate debt as % of gdp

- and also the amount that is rated BBB

- I view shorts as a source of profit and not just a hedge

- We look for what sectors that are vulnerable

- We’re either shorting companies that are in vulnerable sector, or find some common themes

- e.g. media shorts, eyeballs going away. They’re vulnerable to shifting industry trends, also vulnerable in downturns, and have high leverage

- My short book has low P/E, high dividend yields, would look like screaming longs but they’re not

- It’s not that these companies don’t see change coming, but they’re in denial and don’t think it will happen to them

- We shorted Conn’s (CONN), a retail store chain

- We take a ‘private company approach to the public markets’

- 80% of the companies we’re long, the CEO is still the largest shareholder

- They have net cash, impeccable balance sheet

- We’re willing to wait for thesis to play out

- Why international? I can get twice the growth for half the multiple outside the US

- e.g. India shoe ownership is 1.6 pairs per person vs US is way higher. Which is more likely to double?

- Long Relaxo, (RELAXO), a footwear company in India, they have 20% of market cap in cash, single digit mkt share,

- e.g. Towers have high operating leverage since towers can put many receiver boxes. Hence the tower companies can take on debt. That’s why you get high multiples such as 24x ebitda for Crown Castle.

- Long Helios towers (HTWS), they’re trading at 10x ebitda, average tenancy of 2, will be able to increase

- I owned european Cellnex because they were underearning, could increase tenancy, and that story played out

- New and emerging fund managers are struggling, and we need to fill the funnel.

- You need cognitive diversity to succeed

- It’s not that women aren’t trying but they aren’t getting to scale.

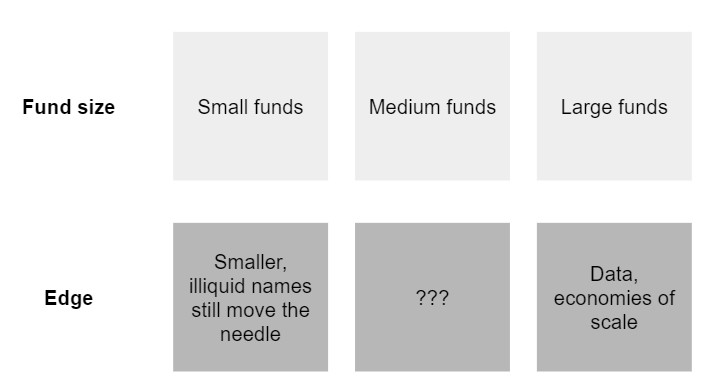

- If you’re <250mm assets you have <50% chance of surviving according to this GS study I’ve seen

- Is there a way to bring down the minimum viable AUM needed?

- You need a way to make the fund sustainable for the manager, not just investors

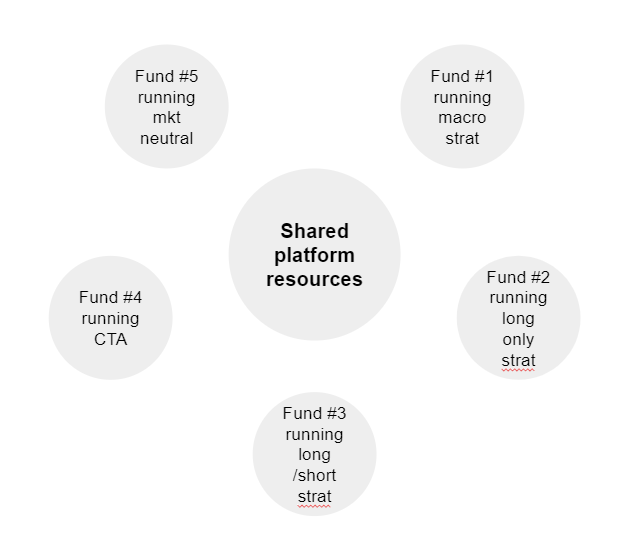

- I’m exploring the idea of a platform that allows smaller fund managers to outsource the admin. e.g. raise $1bn to fund 5 different managers who share the same CFO and admin

- What’s the hidden obstacle on why this pooling of managers at subscale hasn’t happened yet?

- I think the idea of a platform isn’t novel. It works in all sorts of industries, but everyone I’ve spoken to says it’s really hard to do for investing

- You’d need at least $500mm-1bn to fund 5+ strategies.

- It would be the largest investment in diversity in the investment industry.

- One tough part would be getting one LP to fund the entire venture.

- Can you do 5 endowments at $200mm each? Sure, but then you’d need to get all of them to agree to this novel platform idea

LL - I liked Barbara’s talk a lot, though I disagreed on some points. I’m unsure if corporate debt ratings mean much since ratings are all a game anyway; I speak from experience having put together ratings presentation decks for companies requesting ratings from the credit rating agencies. I’m also unsure if shorting for alpha works as a strategy vs shorting so that you can be more aggressive on your longs, as Chanos and others have mentioned

Besides the idea pitches, what I found most interesting was the idea of an investment platform to serve multiple fund managers at sub-scale. If I’m interpreting her correctly, it would be like a mini-Citadel / Millenium / DE Shaw etc. The platform would provide common pooled resources such as data, administrative help, network, and the fund managers would have more free time to do investment research rather than spend time marketing. It seems like it could work, though my friend brought up two issues:

1) What would be what happens when the fund managers do well? If you grow from a $200mm pod to $1bn, the LPs that are interested in you would likely change as well. Would you expect them to stick with the platform?

2) Wouldn’t fund managers be concerned about confidentiality, particularly around their returns? If you have one finance team handling investor relations, the fund manager loses control over how and what they report. Perhaps that’s better for transparency, but how many managers would be willing to do so?

Cliff Asness, AQR

- Before I begin, I want to caveat that a lot of what I’m presenting hasn’t worked in the last 2 years

- If you look at them separately, equity and bond real yields are low, but not unprecedented.

- However, if you combine them into a 60/40 portfolio, the expected real return of both is very low vs history.

- The reason is that historically both wouldn’t get expensive at the same time, but now both are expensive

- If you look at the past over a long time period and see 5% returns, you can’t use that same 5% assumption going forward when current yields are much lower. You should use the 2% real return going forward instead

- To be an interesting factor, it needs to have some economic sense, and it needs to be usable to sort managers

- One caveat is that ppl are very good at making a story to justify the factor after seeing the data

- Some factors that most ppl have settled on include: value, momentum, carry, defensive, trend, volatility

- Over the years I’ve come to think we’re more similar to others than i believed in the past

- Value has suffered in the last 5-10 years

- However, one thing we’re noticing is that there is an increasing gulf (value spread) between the cheap and expensive names now

- Every strategy is hard to stick with, but if you don’t you’ll fail

- How do you view the Ren Tech comment about how they would trade on signals that don’t make sense?

- Renaissance runs on high frequency trading signals that dont necessarily make sense. They’re doing a different thing than what we do. We hold for 3mths+, and I would be hard pressed to do that without some economic explanation

- HFT is like quantum mechanics and sometimes inexplicable

- Why haven’t things worked in past year?

- I don’t know

- Sometimes you just can’t explain why

LL - AQR and Cliff have published an abundance of research on their site. Cliff has discussed these points before, and what I found most interesting were:

1) How he’s come to believe there’s more similarity between AQR and comps that he’d thought. If such a respected fund is saying this, you have to wonder what the relative edge between investors is, and how you can get it. Particularly for the individual investor, since you’re not going to have access to the same information or analysis. Perhaps the edge is timing, as John Huber writes about

2) The importance of sticking with your strategy. The key problem here of course is how to separate stubborness from discipline, as Matt Levine writes about. How do you know when the world has indeed changed, and your old investment process is outdated?

3) The willingness to admit that sometimes things are just inexplicable. As he mentioned, it’s too easy to construct a narrative that explains how something occured. The stock beat earnings and went up? Oh because they beat expectations. The stock beat earnings and went down? Oh because they beat expectations but not as much as they were expected to beat.

Michael Weinberg, APG

- We’re a pension fund allocator / administrator for Netherlands

- We think businesses should be held to a high standard, should care about the environment and the world

- We care about integrity of markets; markets should be fair,

- When I was at Soros, he’d recommend putting your for profit and non profit intentions in separate buckets, treat them separately. Use the profits from the for profit side to fund the non profit side

- We’re absolutely seeing more ppl interested in ESG

- We track how much companies are contributing to SDI goals and see how that changes over time

- We invest in both companies that are doing well in SDI as well as those that can improve. We want to engage with the latter group and help them improve

- How are fund managers today different from the past?

- The managers we believe will have an edge are those that will be using machine learning or alternative data.

- In the past the outperformers went out in the physical world and collected data, now we think they’ll do same thing but with machine learning instead.

- The computer can look at more securities than you can.

- If you’re not doing machine learning, you need to work on inefficient markets e.g. asia/europe, or smaller market caps, where machine learning is less prevalent

- The future hires at funds would be data science, programmers rather than finance people

LL - If the succcessful investors of the future are going to be the ones doing machine learning, that implies we’d see either huge firms or small firms survied. The medium sized firms that are a few billion in AUM would be in the tough zone of having too much capital to earn high returns but also too little to have data for alpha. Investing is still currently a human phenomenon though, and I wonder if that will change

Jamie Dinan, York Capital

- The internet has democratised everything, including information flow

- Ppl used to be able to literally get the news a day before, you can’t do that now

- I want to answer

- What do i need to know,

- Who knows that,

- and of that group, who can tell me about it?

- Job advice? Go where your passions are

- Things that we do today are things machines cant do yet e.g. troubled loans, real estate in europe.

- We dont want to compete with the machine alpha busters

- We were in business 8 years before even hiring a marketing person. In the long run that worked, but you have to be patient

- Have merger arbitrage spreads been commoditized?

- Yes, playing vanilla merger arb prob only makes sense for large firms

- If anyone is making a lot of money, there’s probably dozens of ppl trying to figure out how to get that lunch

- One example of disruption is through disruption of monopolies

- e.g. mastercard, visa still are making money from their monopoly.

- If we go to a digital world, why should you as a merchant give 2% to these guys?

- Now the paradigm is merchants accept mastercard and visa, might decline Amex

- What’s going to happen when merchants don’t take mastercard and visa?

- crypto applications to move money for free

- Besides business monopoly, I also think of disruption from a regulatory standpoint

- e.g. anger in california at PGE

LL - I’m less sure about the follow your passion advice since many people don’t know what their passion is yet.

Michael Mauboussin, BlueMountain

- Today I want to talk about teams

- How big should a team be

- How to assemble it

- How to make it effective

- There’s been a change in fund leadership, from single managers to multi managers in a team. Where you would once have just one rockstar PM, now there’s a team at the top

- The ideal team size is 3 [He said both 3 and 4] to 6

- Odd number teams work better than even number teams since you can tiebreak

- Cognitive diversity is key to improved prob solving, not social/racial/cultural diversity. Cognitive diversity includes:

- information,

- knowledge,

- heuristics,

- representations,

- mental models,

- personality

- Scott Page, author of The Diversity Bonus, writes about a diversity prediction theorem.

- Collective error = average individual error - prediction diversity

- Higher prediction diversity, the lower the collective error

- The Psychology of Intelligence Analysis has this great quote

- “Analysts who know most about the situation have the most to unlearn when world changes”

- Are you willing to ask the naive question, or are you encumbered by your knowledge?

- The number one problem in organisations is ppl feel scared to voice their opinion, especially when seniority comes in play

- How many times have you been in a meeting with the CIO and everyone just listens to what they say

- Robert Sapolsky, author of Why Zebras Don’t Get Ulcers, did research on stress

- Physical stressors induces the same stress response as psychological stressors

- When you’re stressed you pull in your time horizon. If you’re stressed you stop thinking about the long term

- Good leaders run meetings this way

- They keep to agenda

- They don’t share their view until end, if at all. This helps with reducing bias

- They elicit views, since this helps with the introvert who may have something to express

LL - There was so much good content here, as expected from Mauboussin. I’ve written about Mauboussin before. The highlights for me this time were:

1) The ideal team size is small!

2) It’s cognitive diversity, not social/racial/cultural diversity that counts. This makes sense, though I’d caveat against placing too much emphasis on social science research, since we know there’s a current replicability crisis

3) The people that have the most specialised knowledge have the most to unlearn when things change. Kinda reminds me of the hedgehog vs fox argument that Tetlock poses in superforecasting, where the more specialised experts were worse at prediction

4) There have been so many situations I’ve been in where someone more junior speaking up would have resulted in a significantly better outcome for everyone. When your bonus is dependent on you agreeing with your boss though, why rock the boat? Recall what Eileen of Bridgewater wrote above. Senior people like to say they’re open to radical feedback until they actually get some

5) The pulling in of your time horizon when you’re stressed also makes sense

A question I wanted to ask but didn’t have the chance to: In the teams of 3 to 6, should decision making be unanimous or based on majority vote? I asked this on twitter and got a tangentially related response that didn’t answer this directly, but gave fascinating analysis of decision making in even larger teams

If you liked this, sign up for my monthly finance and tech newsletter