Saber Capital info vs time edge

I’ve found John Huber’s categorisation of investment edge indispensable in thinking about investing. He recently wrote more about it here [1].

Everyone understands that there is no info edge in Facebook or Apple. But there isn’t any info edge in smaller stocks either, at least not in a meaningful way that can be reliably utilized.

I talked about the erosion of information edge from expert networks in my notes on an investment conference. I’m unsure if this is as widely believed as John thinks though. In my experience many people still seemed to quote alternative data sources e.g. app usage data, expert network interviews, management meetings as sources of information edge on large cap companies. There’s a difference in what people think they have vs what they actually have, which ties into Huber’s point directly below:

I’ve observed over the years that whatever information an investor believes to be unique is almost always understood by many other market participants, and thus is not valuable. The mispricing is not in the stock itself, but in the investor’s own perception of the value of information.

This I do believe. Everyone thinks that their information is unique, but it really isn’t.

investment decisions were made that had nothing to do with long-term value and everything to do with short-term stock price.

With the success of larger platforms such as Citadel, Millenium, DE Shaw that run multiple groups all trading on short-term movements [2], the market has shifted its focus towards winning with this investment style. Geoff Yamane talks about information speed and investment alpha, which I respond to here.

it solidifies two things that I already am very convinced of:

First, I have no informational edge, I don’t think anyone else has one either. But I don’t think you need one.

Second, the investor who is willing to look out three or four years will have a lasting edge because […] the deterioration of the info edge has actually increased the size of the “time horizon” edge.

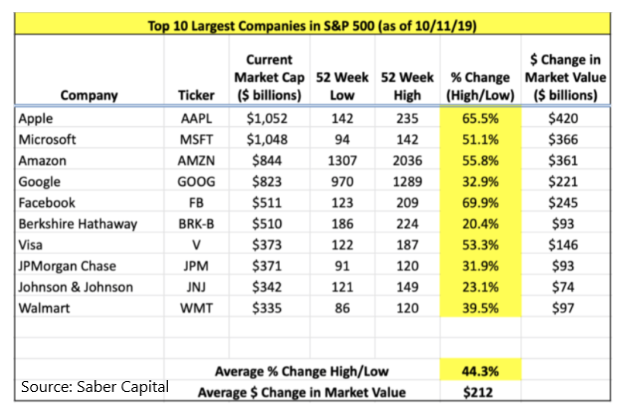

I like this chart that Huber keeps track of, which shows that even for large cap stocks, the difference in their 52 week high vs their 52 week low is still tremendous. But since you’ve sold out of the name after a 10% earnings dip, you don’t get that time horizon edge.

What about the second edge, analytical advantages? John doesn’t discuss it as much, but I personally think it’s similar to the informational edge. Many people think they have a unique analysis on the public information, but the bull and bear case for a company is usually widely understood already.

The time horizon edge could be summed up this way: the price of gaining this edge is the volatility that could occur in the near term.

Many fundamental investing firms say they are long term oriented e.g. a typical Tiger Cub would aim for 3 year doubles. However, they themselves are subject to their limited partner pressure for quarterly results. It’s easy to say before the fact that you’ll double down on a losing investment, but few do it in practice. Let alone 50% declines, people start getting worried at 5% declines.

Footnotes

- A more detailed piece can be found here as well

- Based on my understanding of how these larger shops work, but lmk if mistaken.

If you liked this, sign up for my monthly finance and tech newsletter: